Why Surcharging Is a Bad Move For Small Businesses — and What to Do Instead Before you add credit card surcharges, learn what the big players know — and how to protect your business from costly mistakes.

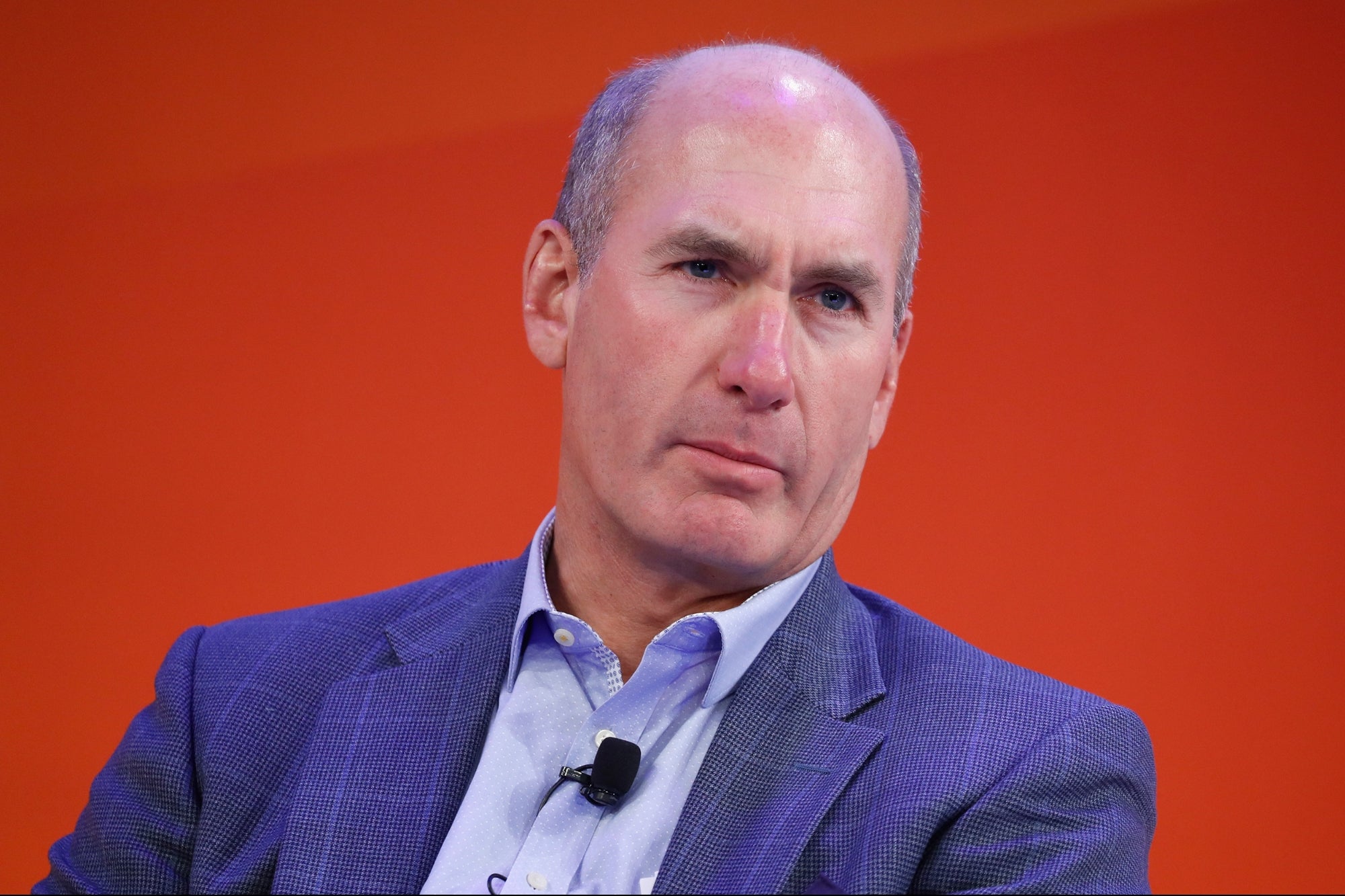

By Robert L. Day Edited by Kara McIntyre

Opinions expressed by Entrepreneur contributors are their own.

I belong to a CEO peer group, and I love connecting with leaders who are further along in their journey. I work hard to keep my mouth shut and my ears open — because let's be honest, they have way more to teach me than I have to teach them. I also love it when they let me record our conversations on Plaud so I can revisit the gold later.

I used to think that most CEOs and business owners approached their growth the same way: by learning from those ahead of them. But lately, I'm starting to wonder.

Why? Because right now, I'm watching a surcharging frenzy unfold. Small and midsize merchants are racing to add extra fees to customers' bills to cover credit card processing costs. Yet not one major player is doing it. Not Apple. Not Walmart. Not Amazon. Not Target. Not Costco. None of them.

So, what do they know that others don't?

Related: Is Your Credit Card Processor Secretly Costing You a Fortune? Watch for These 5 Red Flags

What is surcharging (and why should you care)?

Surcharging means adding a fee at checkout to cover the cost of customers paying with a credit card. It sounds simple. But staying compliant with some of the states and card-brand rules is anything but.

Each card network (e.g. Visa, Mastercard) has its own set of rules, and some states ban surcharges altogether. The result? A regulatory mess where one slip-up can lead to fines, customer backlash or both.

Why the big players avoid it

Big companies have armies of lawyers and compliance experts. They also utilize firms to help them reduce their fees without ticking off customers. Most importantly — they understand the hidden dangers of surcharging:

Legal risks: Missteps can trigger fines from card networks or regulators. Fines can exceed $10,000 per violation.

Processor traps: Many merchant agreements let processors pass their own fines onto you if you're caught surcharging incorrectly. That means you could get hit twice.

Customer friction: Surcharges annoy customers. Studies show surprise fees lead to higher cart abandonment rates and fewer return visits.

In short: Big companies know that surcharging often costs more in lost business and legal headaches than it saves on fees.

What's really driving up your fees?

Here's the kicker: If your merchant fees are climbing, it's probably not because the networks are hiking their rates. Interchange fees — the core cost of processing — have barely budged in the last 15 years.

So where's the extra cost coming from?

- Inflated fees: This is when a processor inflates the actual cost of the fees, i.e. charging you 2.95% when the exact fee is only 2.25%.

- Made up hidden fees

- Charging high discount rates, your discount rate should be fully disclosed, broken out, and only between 2 and 7 basis points at most, and if you are processing over $10 million a year, more than 4-5 basis points, over $100 million a year, 2-3 basis points.

- Keeping rebates: Most businesses are unaware that they should receive their processing fees back on returned or voided sales, and the credit card processor pockets those refunds. For merchants with a high volume of returns, this can add up significantly.

What smart business owners do instead

If you want to reduce credit card processing costs without the risks of surcharging, here's the playbook:

Get a merchant processing audit: An independent audit can reveal hidden fees, excessive markups, and junk charges. At my firm, we see clients reduce their fees as much as 40%. To be fully transparent, several firms offer this service, so be sure to do your research and find the one that best suits your needs.

Ask about interchange optimization: This ensures your transactions qualify for the lowest possible rates under the existing rules — no customer friction required. Make sure they show you that your transactions are clearing at the lowest interchange. Don't just take their word for it.

If you must surcharge, get expert help: Work with a firm that understands all state laws and card-brand rules. Ensure you're registered properly and following the strict requirements — because one mistake can cost you dearly. Also, there are firms that will take ownership of the compliance and cover your fines should you get fined.

Related: How to Choose a Credit Card for Your Startup

My final thoughts

How do you feel when you get surcharged? Business becomes increasingly competitive every day, and I believe most people will do business where they feel wanted and valued, which is a lost art, but not everywhere.