How Smart Entrepreneurs Turn Mid-Year Tax Reviews Into Long-Term Financial Wins Take these four steps to set yourself up for financial success at the end of the year and beyond.

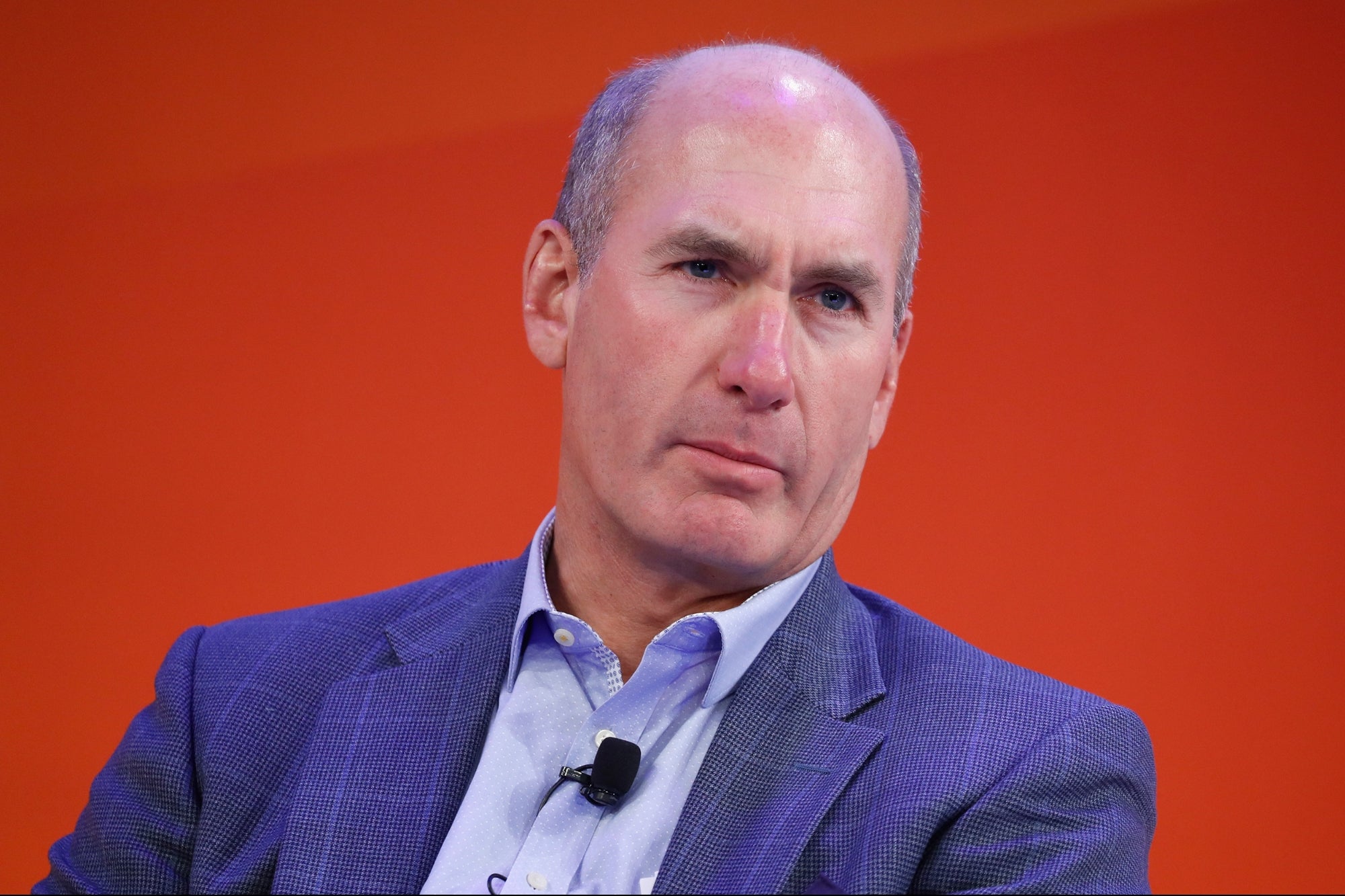

By Tom Wheelwright Edited by Maria Bailey

Opinions expressed by Entrepreneur contributors are their own.

We're halfway through the year. The plans you set in motion back in January are hopefully moving along — and let's be honest, the sunshine is calling. For most entrepreneurs, tax planning won't resurface until the year-end scramble or next spring's filing season.

But if you're serious about improving your financial picture, now is the time for a mid-year tax strategy check-in. It doesn't have to eat up your summer. Carve out a day or a few afternoons to look at these four areas, then schedule a meeting with your tax advisor. You might be surprised how far a little mid-year focus can take your business — and your finances.

Related: 5 Tips for Finding the Tax Advisor Who Will Save You Millions

1. Know your numbers

You can't improve what you don't understand. Start by reviewing your core financial metrics — revenue, expenses, cash flow and customer acquisition costs. Compare these to your business plan. Are you on track? Are there red flags or overlooked opportunities?

Also, come prepared to your advisor meeting with a clear estimate of your taxable income and projected tax liability. The last thing you want is a nasty surprise in April.

2. Maximize your deductions

Running a business comes with plenty of expenses — and many of them are deductible. That means they reduce your taxable income and, ultimately, your tax bill. It's the government's way of incentivizing reinvestment into your business.

Common deductible expenses include:

- A reasonable salary for yourself

- Travel related to business

- Equipment, software, and other depreciable assets

- Home office expenses

- Continuing education

To prepare, make a list of your 2025 business expenses so far, plus projected spending through year-end. Then ask:

- Is there a clear business purpose?

- Is this a typical expense in your industry?

- Is it necessary (i.e., does it drive profit or growth)?

- Do you have proper documentation?

Bring any questionable items to your advisor for clarification. There could be savings you're missing.

3. Explore available tax credits

While deductions reduce your taxable income, tax credits reduce your tax bill dollar-for-dollar — and in some cases, can even increase your refund.

Ask your advisor if you're eligible for any of these common credits:

- Providing child care for employees

- Offering paid family and medical leave

- Using individual-choice HRAs

- Creating jobs in economically distressed areas

- Investing in research and development

Tax credits are often underutilized, and a knowledgeable advisor will help you take full advantage of them.

Related: Why Mid-Year Tax Reviews Are a Must for First-Time Entrepreneurs

4. Think beyond this year

Yes, this review should help lower your 2025 tax bill. But the bigger win is long-term planning. Use this mid-year moment to zoom out: Are you building a system for long-term, tax-efficient wealth? Are you investing in ways that align with your growth strategy and the broader economy?

The tax code is full of incentives designed to reward entrepreneurs. That's not a loophole — it's a signal: the government wants you to grow, because you create jobs and fuel the economy.

So don't settle for a CPA who just files your paperwork. Find an entrepreneurial advisor who can help you build a lasting, proactive strategy — someone who acts as a true financial partner, not just a form-filler.

A mid-year review could be the most lucrative move you make all year Taking a few hours to revisit your numbers, check for missed opportunities, and talk strategy could save you thousands — and set your business up for a stronger finish to the year. More than that, it helps you lead with clarity, confidence, and control over your financial future.